Figuring Out the Refine: How Can Discharged Bankrupts Obtain Credit Report Cards?

Navigating the world of charge card applications can be an overwhelming task, especially for people who have actually been released from insolvency. The procedure of restoring credit post-bankruptcy poses unique difficulties, usually leaving lots of questioning regarding the feasibility of getting charge card as soon as again. However, with the best methods and understanding of the qualification requirements, discharged bankrupts can embark on a journey towards monetary recuperation and access to credit history. However exactly how precisely can they browse this complex process and safe credit scores cards that can help in their credit restoring journey? Let's discover the methods readily available for released bankrupts aiming to improve their credit reliability with credit history card options.

Recognizing Bank Card Qualification Standard

One crucial variable in bank card qualification post-bankruptcy is the person's credit report. Lenders frequently think about credit history as an action of a person's creditworthiness. A higher credit rating signals liable monetary actions and may result in better credit score card alternatives. Furthermore, showing a stable revenue and employment background can positively influence bank card authorization. Lenders seek assurance that the person has the methods to pay back any debt reached them.

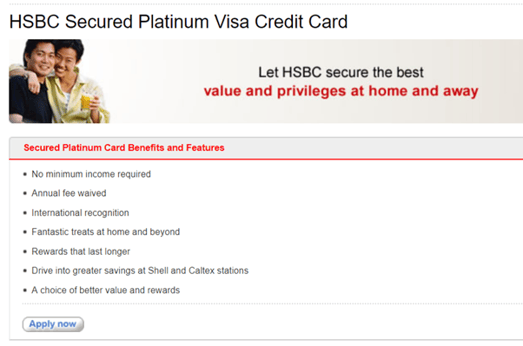

In addition, individuals need to know the various types of bank card readily available. Safe credit scores cards, for circumstances, call for a cash deposit as security, making them much more accessible for people with a background of insolvency. By recognizing these eligibility requirements, people can navigate the post-bankruptcy debt landscape better and function towards restoring their monetary standing.

Reconstructing Credit Scores After Bankruptcy

One of the initial actions in this procedure is to get a safe credit card. Secured credit rating cards require a cash money deposit as collateral, making them much more available to individuals with a personal bankruptcy background.

Another strategy to restore debt after personal bankruptcy is to end up being an authorized individual on somebody else's bank card (secured credit card singapore). This enables individuals to piggyback off the key cardholder's favorable credit rating, possibly improving their very own credit report

Regularly making on-time payments for expenses and financial obligations is important in rebuilding debt. Settlement background is a significant consider identifying credit report, so showing accountable monetary actions is important. In addition, routinely keeping track of credit scores records for inaccuracies and errors can aid make sure that the details being reported is correct, further aiding in the credit score restoring process.

Safe Vs. Unsecured Credit Cards

When thinking about charge card alternatives, individuals may come across the option in between protected and unprotected bank card. Guaranteed credit cards require a cash deposit as collateral, generally equal to the credit line approved. This down payment safeguards the issuer in case the cardholder defaults on payments. Secured cards are often recommended for people with bad or no credit rating background, as they give a means to develop or rebuild debt. On the various other hand, unprotected bank card do not need a deposit and are given based upon the cardholder's credit reliability. These cards are much more common and commonly come with higher credit restrictions and lower costs contrasted to protected cards. Nonetheless, people with a history of personal bankruptcy or poor credit rating might discover it testing to receive unprotected cards. Choosing in between secured and unsecured bank card depends on an individual's economic circumstance and credit objectives. While secured cards supply a path to enhancing credit scores, unprotected cards offer even more flexibility yet may be more challenging to obtain for those with a struggling debt history.

Looking For Credit Score Cards Post-Bankruptcy

Having actually reviewed the distinctions between secured and unsafe credit cards, individuals who have undergone personal bankruptcy might now take into consideration the procedure of getting bank card post-bankruptcy. Restoring debt after personal bankruptcy can be tough, yet acquiring a credit rating card is an essential action in the direction of enhancing one's credit reliability. When obtaining bank card post-bankruptcy, it is vital to be calculated and careful in selecting the right alternatives.

Additionally, some individuals might qualify for specific unprotected credit rating cards particularly created for those with a history of insolvency. These cards might have greater costs or interest rates, however they can still give an opportunity to rebuild credit score when made use of responsibly. Before requesting any type of credit scores card post-bankruptcy, it is a good idea to examine the problems and terms very carefully to comprehend the charges, rate of interest prices, and credit-building capacity.

Credit-Boosting Strategies for Bankrupts

Rebuilding creditworthiness post-bankruptcy requires executing reliable credit-boosting techniques. For people looking to boost their credit report after bankruptcy, one crucial strategy is to get a safe bank card. Protected cards require a cash deposit that works as security, allowing individuals to show liable credit history use and payment actions. By making prompt repayments and keeping credit score use low, these people can slowly rebuild their credit reliability.

Another method involves ending up being an accredited individual on a person else's credit history card account. This allows individuals to piggyback off the key account holder's favorable Read More Here credit report, possibly increasing their very own credit report. However, it is vital to ensure that the key account holder maintains great debt practices to make the most of the benefits of this technique.

In addition, consistently keeping an eye on credit reports for errors and contesting any type of mistakes can additionally assist in boosting credit history. By staying positive and disciplined in their debt management, individuals can gradually enhance their credit my blog reliability even after experiencing insolvency.

Conclusion

In conclusion, discharged bankrupts can obtain bank card by meeting eligibility criteria, rebuilding credit rating, understanding the difference in between safeguarded and unsafe cards, and using tactically. By complying with credit-boosting methods, such as keeping and making timely payments credit rating utilization reduced, insolvent individuals can progressively boost their credit reliability and access to bank card. It is very important for discharged bankrupts to be mindful and diligent in their economic habits to successfully browse the process of acquiring charge card after bankruptcy.

Recognizing the rigid credit report card eligibility criteria is important for people seeking to obtain debt cards after insolvency. While secured cards use a course to enhancing credit scores, unsafe cards supply even more versatility yet might be harder to get for those with a troubled credit scores background.

In final thought, discharged bankrupts can acquire credit history cards by meeting eligibility standards, rebuilding credit history, comprehending the distinction between protected and unsafe cards, and using tactically.